Lately, the uncertainty of global markets and the volatility of traditional investments have led many individuals to discover alternative options for his or her retirement financial savings. One such possibility that has gained significant popularity is the Gold Particular person Retirement Account (IRA). With the rise in demand for gold as a hedge against inflation and financial instability, quite a few companies have emerged to cater to this rising market. This text delves into the world of Gold IRA investment companies, exploring their choices, advantages, and the factors investors ought to consider when selecting a supplier.

Gold IRAs are specialized retirement accounts that enable buyers to hold physical gold and different valuable metals as part of their retirement portfolio. Not like traditional IRAs, which sometimes encompass stocks, bonds, and mutual funds, Gold IRAs present a tangible asset that has historically retained its value over time. As a result, many buyers view gold as a safe haven during instances of financial uncertainty, making Gold IRAs a lovely choice for retirement savings.

The surge in curiosity in Gold IRAs has led to the proliferation of funding corporations that specialize on this niche market. These corporations sometimes offer a variety of providers, including account setup, storage solutions, and steering on the varieties of valuable metals to spend money on. A few of the most distinguished Gold IRA investment companies include Regal Assets, Birch Gold Group, and Augusta Valuable Metals. Each of those corporations has carved out a status for offering dependable services and skilled recommendation to buyers looking to diversify their retirement portfolios.

Certainly one of the key advantages of investing in a Gold IRA is the potential for tax advantages. Much like conventional IRAs, contributions to a Gold IRA may be tax-deductible, and the expansion of the funding is tax-deferred until withdrawal. This permits investors to maximize their savings while enjoying the advantages of holding a tangible asset that may appreciate over time. Moreover, gold is often viewed as a hedge in opposition to inflation, which may erode the buying energy of money and different traditional investments. As inflation charges rise, many buyers flip to gold to preserve their wealth, making Gold IRAs an appealing possibility for these involved about the long-time period stability of their retirement savings.

When selecting a Gold IRA investment company, it is crucial for investors to conduct thorough research and consider a number of components. At first, the company's reputation and monitor file are essential. Buyers ought to search for firms with positive customer critiques, clear price constructions, and a history of profitable transactions. Moreover, it's important to make sure that the company is respected and compliant with IRS rules relating to the storage and handling of treasured metals.

Another crucial issue to think about is the vary of products supplied by the funding firm. While most Gold IRA suppliers focus primarily on gold bullion, many additionally provide silver, platinum, and palladium as investment options. Buyers ought to assess their preferences and consider diversifying their portfolios with a mix of different valuable metals. Moreover, companies that provide educational resources and customized guidance might be invaluable for buyers who may be new to the world of treasured metallic investments.

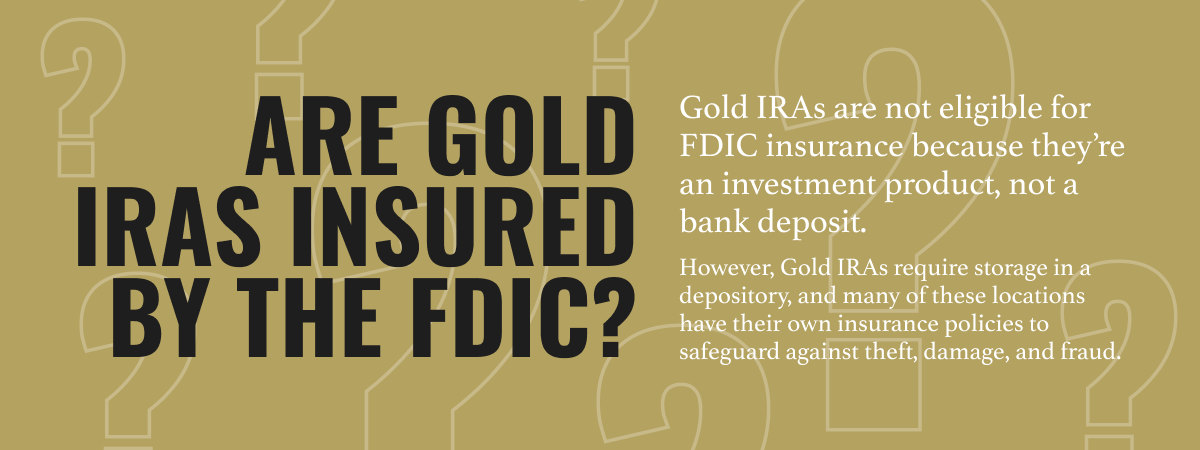

Storage options are one other vital side of Gold IRAs. The IRS requires that bodily gold and different treasured metals held in a Gold IRA be stored in an accepted depository. Investors should inquire concerning the storage options supplied by the funding firm, together with the safety measures in place to guard their assets. Some companies supply segregated storage, where an investor's metals are stored individually from these of different clients, while others could make the most of commingled storage. Understanding these choices may also help traders make informed selections about where and the way their property might be saved.

Fees associated with Gold IRAs can differ significantly from one firm to a different. Widespread fees include account setup fees, annual maintenance charges, storage charges, and transaction fees. Investors should carefully assessment the charge constructions of potential Gold IRA suppliers to make sure they aren't overpaying for companies. Transparency in pricing is essential, as hidden charges can eat into funding returns over time.

Furthermore, buyers should consider the extent of customer support and help offered by the Gold IRA investment company. A responsive and knowledgeable workforce can make a major distinction in the general experience, particularly for many who may have questions or require assistance all through the investment course of. Companies that prioritize buyer training and provide sources equivalent to market evaluation, funding guides, and common updates can assist traders keep informed and make sound selections.

Because the demand for Gold IRAs continues to rise, the competitors among funding corporations is likely to increase. This might lead to improved providers and decrease charges for buyers, making it an opportune time to discover the benefits of gold as part of a diversified retirement portfolio. Nonetheless, prospective investors should stay vigilant and do their due diligence to ensure they're partnering with respected corporations that align with their funding goals.

In conclusion, Gold IRA investment companies play a crucial function in helping people secure their retirement savings via valuable metals. With the potential for tax advantages, a hedge towards inflation, and the stability of bodily property, Gold IRAs have emerged as a preferred alternative for many buyers. By conducting thorough analysis and contemplating factors akin to fame, product offerings, storage options, fees, and customer support, traders could make knowledgeable decisions and discover a Gold IRA provider that meets their needs. As the economic panorama continues to evolve, gold stays a trusted asset, and Gold IRAs offer a viable path for individuals searching for to guard their financial future.